Investment Banking Target Schools List: UK & US Edition (2025–2026)

- City Investment Training

- Dec 23, 2025

- 4 min read

By City Investment Training

Studying at a target or semi-target matters in investment banking because it puts you on the main recruitment pipeline. Banks hire efficiently, and these universities offer built-in access: campus presentations, closed networking events, strong alumni networks, and earlier visibility for spring weeks and summer internships. Recruiters also trust the “signal” of these schools, so your CV is more likely to be read and taken seriously, which usually means more interviews with less friction.

But it’s not a golden ticket. A target school gives access, not an offer. You still need technical skills, sharp interview performance, and consistent networking to convert opportunities. Semi-targets can be just as viable if you’re proactive, and non-target students can still break in by stacking proof of skills and building relationships. Pedigree opens doors, but preparation decides who gets through them.

This guide shows the UK + US target and semi-target shortlist most relevant to investment banking recruiting, plus what to do if you’re outside Tier 1.

Quick Answer: What is a “Target School”?

A target school is a university where investment banks consistently recruit through a mix of:

On-campus (or society-led) events

Dense alumni networks in front-office roles

More consistent interview pipelines

Target = easier access to interviews.

A semi-target places students every year too, but you generally need to be more proactive with:

Networking

Early experience

Technical preparation

Semi-target = access exists, but you must push harder.

Non-target = still possible, but you must create access with networking + proof of skills.

What are the target schools for Goldman Sachs?

Goldman Sachs does not publish an official “target school list.” In reality:

Certain universities appear more often in pipelines (alumni density + recruiting infrastructure)

Goldman also runs structured early insight routes and multi-stage screening that can open doors beyond traditional feeders

Translation: the school can help you get seen. Your skills determine whether you get chosen.

Tier 1 (Target) vs Tier 2 (Semi-Target): UK & US (2025–2026)

Not official. “Target” varies by bank, office, and division (IBD vs S&T vs ER). Use this as a practical starting point, not scripture.

United States

Tier 1 (Targets / “Super Targets”)

UPenn (Wharton)

Harvard

Columbia

Princeton

Yale

NYU (Stern)

University of Chicago

Duke

Stanford

MIT

Tier 2 (Semi-Targets)

Michigan (Ross)

Virginia (McIntire)

Georgetown

Cornell

Northwestern

Notre Dame

UC Berkeley (Haas)

UNC Chapel Hill

UT Austin (McCombs)

Vanderbilt

United Kingdom

Tier 1 (Targets)

Oxford

Cambridge

LSE

Imperial

UCL

Warwick

Tier 2 (Semi-Targets)

Durham University

University of Bristol

University of Nottingham

University of Bath

King’s College London (KCL)

University of Edinburgh

University of St Andrews

University of Exeter

Additional schools sometimes viewed as semi-targets (lower consensus):

University of Manchester

University of Birmingham

University of Leeds

How to use this list (so it actually helps)

If you’re Tier 1: Exploit access. Do every event, get interview reps early, and don’t assume brand = offer.

If you’re Tier 2: Start in first term. Top grades + early experience + networking cadence wins.

If you’re non-target: Build a “portable brand”: proof-of-work, a repeatable outreach system, and interview-level technicals.

People also ask

Are target schools the same for every bank? No.

Targets vary by bank, office (London vs New York), and division (IBD vs S&T vs ER).

Is a Master’s degree or MBA required for investment banking?

No for most undergraduate pipelines. It can help later, but it isn’t required to get a summer analyst role.

Do banks care more about university name or experience?

The name can help you get seen. Experience and interview performance usually decide the offer.

When should I start preparing for investment banking?

Ideally first year (UK) or sophomore year (US). Earlier if you’re at a semi-target or non-target.

FAQ

Do banks publish an official target-school list?

No. Lists are unofficial and vary by bank, office, and division.

Is Goldman Sachs school-agnostic now?

Goldman has expanded structured screening and early access routes, but feeder patterns still exist.

Can you get into IB from a non-target?

Yes. The path is just more engineered: networking + relevant experience + technical excellence.

How City Investment Training helps semi-target and non-target students

If you’re not at a Tier 1 target, you need signal (proof you can do the job) and distribution (ways to get seen).

City Investment Training helps you build both:

Technical confidence that shows up in interviews: accounting, valuation, DCF, M&A, LBO, plus how to explain assumptions cleanly

Mock interviews that convert: repetition + feedback until you sound like an analyst, not a student

A networking system you can run weekly: outreach scripts, alumni targeting, follow-up frameworks, referral conversion

Proof-of-work assets: pitch decks, deal write-ups, modelling outputs you can reference in emails and interviews

Bottom line: Target schools help you get seen.

👉 APPLY NOW FOR OUR 8-WEEK INVESTMENT BANKING INTERNSHIP TRAINING PROGRAM

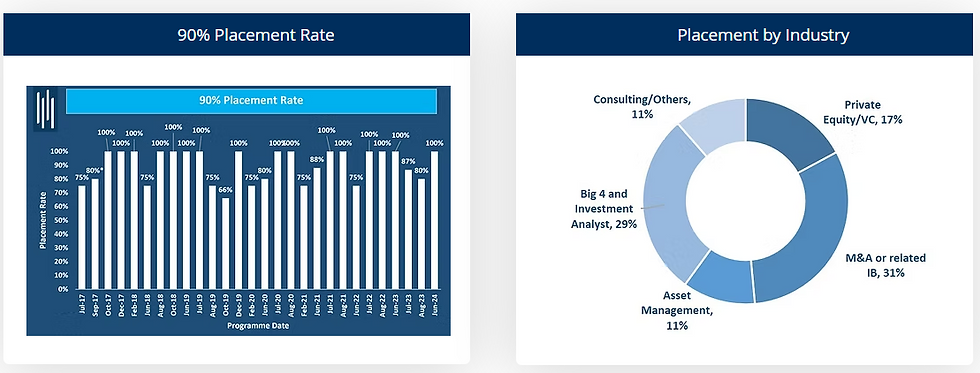

We have a 90% placement rate on our 8-week program with past students securing jobs at marquee banks and PE companies such as Goldman Sachs, Morgan Stanley, JP Morgan, UBS, KKR, Bain Capital amongst many others.

Click here to find out more on our 8-week program: https://www.cityinvestmenttraining.com/full-time-analyst

Comments